The Math of Tax Season 2025-26: Stop Guessing Your Refund with Our Income Tax Calculator

Abstract

Use our 2025-26 Income Tax Calculator to accurately calculate your tax liability and refund. This guide shows you how to treat your taxes like your macros: with precise tracking and data-driven decisions for optimal financial planning. Learn how to use the income tax calculator ay 2025-26 to optimize your financial outcomes.

Introduction: January is for planning, not panic

Look, it's January. Most people are busy ignoring their bank accounts after the holidays, but if you want to optimize your 2026 tax season, you need to use tools like our 2025-26 income tax calculator and treat your taxes like your macros: You have to track the numbers.

Winging your taxes is the financial equivalent of "intuitive eating" while trying to step on stage—it's a recipe for a disaster. The IRS doesn't care about your feelings; they care about the math. If you wait until April to find out you owe $5,000, you've already lost the game of financial optimization. Use our income tax calculator ay 2025-26 to avoid this common mistake.

The "Bro-Science" of Tax Planning

Most people think, "Oh, I made about $70k, my refund should be the same as last year."

Wrong. Tax brackets shift, standard deductions change, and if you moved states or changed your filing status, your "estimation" is basically useless. To get a real result, you need a precise tool that accounts for the variables.

Generic tax calculations don't account for your specific situation. They ignore state taxes, filing status changes, and adjustments that could significantly impact your tax liability. That's why most people are surprised by their tax bill or refund amount.

Breaking Down the Data with Precision

I've been looking at the 2025-26 Income Tax Calculator on Acalculate.com. This income tax calculator ay 2025-26 is clean, it's direct, and it does exactly what it says on the tin.

Step 1: Input Your Real Financial Data

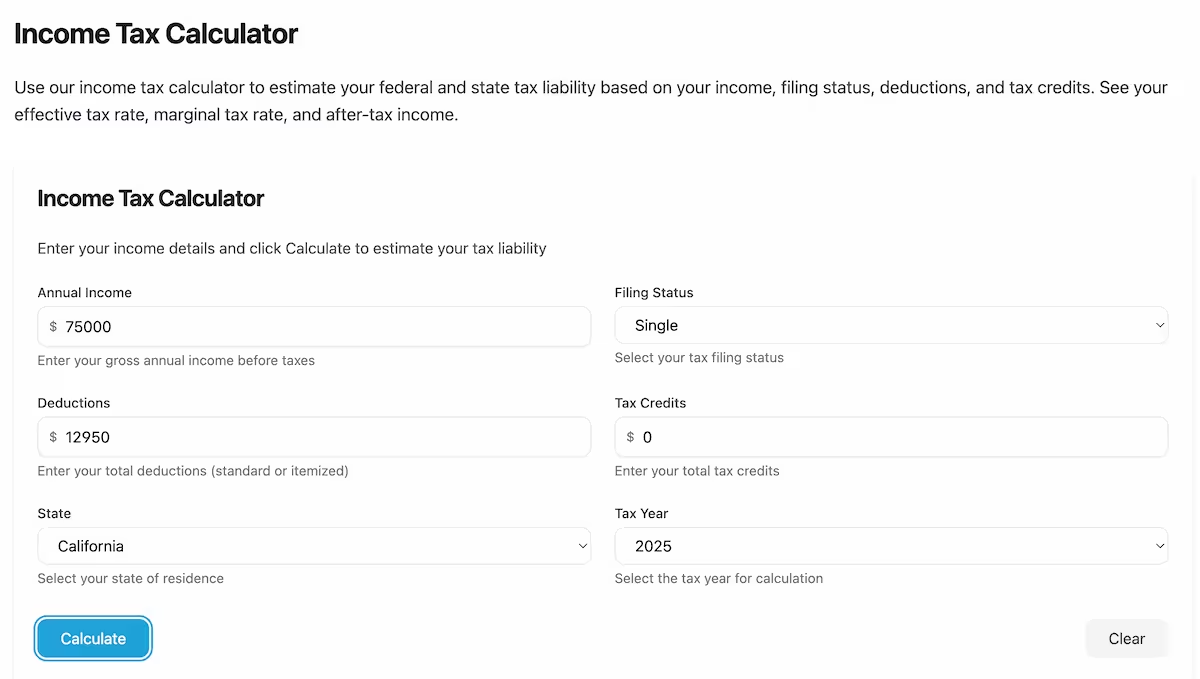

The calculator factors in all the variables that generic tools miss:

- Income Level: Enter your exact annual income

- Filing Status: Single, married filing jointly, married filing separately, head of household

- State of Residence: State tax rates vary significantly

- Deductions: Standard vs itemized deductions

- Dependents: Child tax credits and exemptions

Step 2: Understanding Your Tax Liability

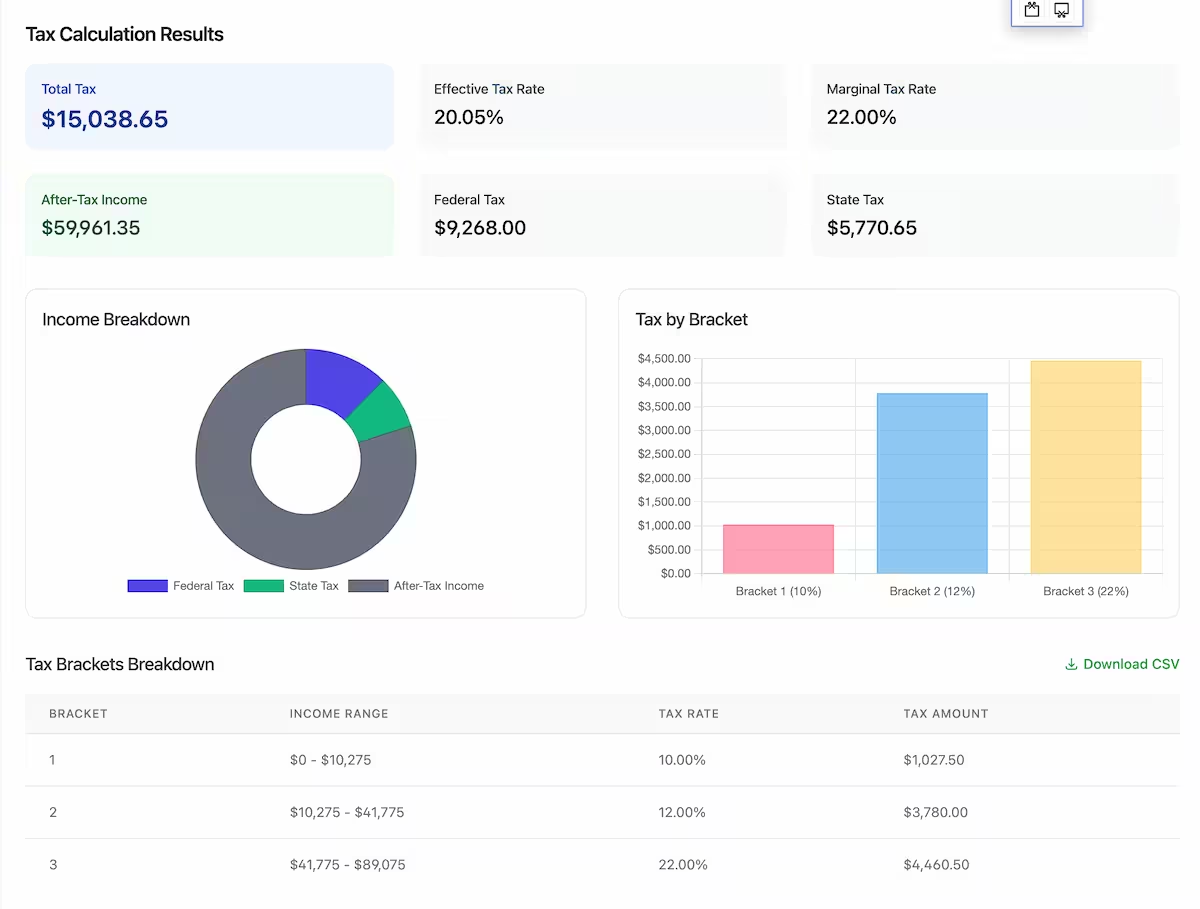

Let's look at a quick case study using our 2025-26 income tax calculator. If you're a single filer in California earning $75,000, your tax situation is significantly more complex than someone in Texas. Let's look at the "experiment results" from the income tax calculator ay 2025-26:

Fig 2: Scientific tax analysis for a $75k salary in California using our 2025-26 income tax calculator.

Fig 2: Scientific tax analysis for a $75k salary in California using our 2025-26 income tax calculator.

This is why I love this specific tool—it translates complex tax law into intuitive data:

- State-Specific Logic: It actually factors in the California state tax (Fig 2 shows roughly $5,770). Let’s be real: this is a massive variable for your take-home pay. If you ignore this, your annual budget is wrong from Day 1.

- Standard Deduction Logic: It’s already programmed with the $12,950+ deduction logic (for the 2025/2026 tax years). You don’t have to waste time digging through hundreds of pages of IRS PDFs; the calculator does the heavy lifting for you.

- The "Bottom Line" (Effective Tax Rate): Notice the Effective Tax Rate (20.05%) in Fig 2. Many people get scared by the Marginal Tax Rate (22.00%), but the effective rate is what actually matters. That is the real percentage of your hard-earned money leaving your pocket.

- After-Tax Income: See that $59,961? That is your true "net weight." Knowing this number allows you to scientifically plan every dollar of your 2026 budget.

How to Optimize Your 2026 Finances with 2025-26 Income Tax Calculator

Don't wait for your W-2 to show up in the mail. Take 60 seconds, go to the 2025-26 Income Tax Calculator, and plug in your projected 2025 earnings. Use our income tax calculator ay 2025-26 for accurate projections.

Strategy 1: Plan for Withholding Changes

Once you know your actual tax liability, you can adjust your W-4 to optimize your take-home pay throughout the year. Don't overpay the IRS with a large refund or underpay with a massive tax bill.

Strategy 2: Estimate Your Take-Home Pay

With your tax calculations, you can accurately determine your take-home pay. This allows you to plan your budget, investments, and expenses with zero guesswork.

Strategy 3: Identify Tax-Saving Opportunities

The calculator can help you identify potential deductions or tax-advantaged accounts that could reduce your liability. Maybe you should be contributing more to your 401(k) or opening an HSA.

Core Strategies for Tax Success

Strategy 1: Run the Numbers Regularly

Use the calculator to estimate your tax liability at different income levels. This helps you understand how raises, bonuses, or additional income streams will impact your taxes.

Strategy 2: Plan for Life Changes

If you're getting married, having children, or moving to a different state, re-run your calculations to understand the tax implications of these changes.

Strategy 3: Track Throughout the Year

Don't just calculate in January. Check your estimates quarterly to ensure you're on track with your financial goals.

Frequently Asked Questions

Q1: How accurate is the 2025-26 Income Tax Calculator?

A: The 2025-26 calculator uses current tax rates and standard deduction amounts for both federal and state taxes. It provides a close estimate for the income tax calculator ay 2025-26, but for complex situations, consult a tax professional.

Q2: Can I use this for business income?

A: The calculator is designed for personal income. For business income calculations, you'll need more complex tax software or professional assistance.

Q3: Should I rely solely on this calculator for tax preparation?

A: While the calculator provides accurate estimates, it's not a substitute for professional tax advice, especially for complex tax situations.

Conclusion: Data is Power with 2025-26 Income Tax Calculator

Data is power. Whether it's your bench press or your bank account, if you aren't measuring it, you aren't managing it. Use our 2025-26 income tax calculator to gain the insights you need.

Go run your numbers with our income tax calculator ay 2025-26, stop the guesswork, and stay smart with your financial planning. With precise tracking and realistic expectations, you'll optimize your 2026 finances with confidence using our 2025-26 income tax calculator.